CHEFA INSIGHTS for October 2025

Insight Highlights

CHEFA awards $475,000 to Hartford Promise as part of the FY 2026 Enterprise Capital Grant Program

CHEFA Chats: Going Beyond the Rating: Mary Wade’s Bold Step Forward

2025 CHEFA Impact Report: Financing Connecticut’s Future

Fiscal Year 2024 Hospital Sector Report Summary

Fiscal Year 2024 Senior Living Sector Report Summary

Fiscal Year 2026 Nonprofit Grant Cycle Announcement

CHEFA awards $475,000 to Hartford Promise as part of the FY 2026 Enterprise Capital Grant Program

The Connecticut Health & Educational Facilities Authority (CHEFA) Board of Directors has awarded $475,000 to Hartford Promise as part of the FY 2026 Enterprise Capital Grant Program. The grant will support the Reaching Beyond initiative, a robust expansion of Hartford Promise’s programs that increase educational opportunities and transform the lives of Hartford students.

“This grant reflects CHEFA’s unwavering commitment to advancing innovative education and workforce initiatives that strengthen communities across Connecticut. By supporting this unique program, we are investing in strategies that have the power to transform career pathways and create lasting impact for learners and employers alike” said Jeanette W. Weldon, Executive Director of CHEFA.

CHEFA established the Enterprise Capital Grant Program to bolster the capabilities and broaden impact of Connecticut nonprofit organizations by providing competitive grants that support strategic initiatives and strengthen balance sheets. The Reaching Beyond initiative builds upon Hartford Promise’s success and addresses an identified challenge facing Hartford Scholars upon graduation from college.

In the last 10 years, Hartford Promise has assisted more than 1,300 Promise Scholars and continues to provide critical support to approximately 500 Scholars in college in any given year. After a decade of working with Scholars, the organization identified specific barriers that often stand in the way of professional success for graduates: lack of professional networks, limited internship experience, and delayed career planning. Hartford Promise’s Reaching Beyond initiative expands and deepens the career support offered to its Scholars while also strengthening career pipelines with employer partners in Hartford and across Connecticut.

Enterprise Capital Grant funds will support expanded career programming for all Hartford Scholars, outreach to employers to broaden the statewide partner network, and biannual Career Fairs to connect Scholars with professionals in their chosen field. In conjunction with Hartford Promise’s existing programs, this work will create a ripple effect that benefits Scholars, addresses Connecticut’s workforce challenges, and fosters a generation of engaged citizens.

“CHEFA is proud to award this grant to a program that stands out for its creativity, collaboration, and potential to deliver meaningful results. We are dedicated to funding initiatives that not only address today’s workforce needs but also lay the groundwork for sustained educational and economic success” said Jen Chapman, CHEFA Grants Program Manager.

CHEFA Chats: Going Beyond the Rating: Mary Wade’s Bold Step Forward

In this episode of CHEFA Chats, we explore how a trusted elder care provider in New Haven pursued an ambitious expansion to better serve Connecticut’s seniors—and how CHEFA helped make it possible through a rare below-investment-grade bond issuance. Hear how the Mary Wade Home transformed vision into reality, creating new assisted living and memory care spaces while strengthening its community impact. This story highlights how mission-driven financing can go beyond the numbers to change lives.

In 2019, the Mary Wade Home in New Haven set out to take a bold step forward. The nonprofit, known for more than 150 years of compassionate elder care, had a vision: to expand its campus, build new assisted living and memory care units, and upgrade critical infrastructure to serve more Connecticut seniors with dignity and comfort.

The scale of the project was ambitious — a 75,000-square-foot facility featuring 84 assisted living apartments, including 20 specialized for memory care. Improvements to the existing campus included a new emergency generator and a cogeneration system for heating and hot water. To make this vision a reality, Mary Wade also needed to refinance over $10 million in existing debt and fund reserve and interest costs.

That’s where CHEFA came in. Through the 2019 Series A-1 and A-2 bond issuance, CHEFA provided access to the capital needed to bring the project to life. But what made this financing truly distinctive was that it was below investment grade — a rarity at the time.

It was a decision that reflected more than financial calculation. It reflected belief — in Mary Wade’s mission, leadership, and impact on its community.

“We don’t just finance credit. We finance impact,” reflects CHEFA leadership in the episode. “This project was about creating a healthier future for Connecticut’s seniors.”

Today, the new facility stands as a testament to what mission-driven financing can achieve. The expansion not only created modern, comfortable living spaces but also strengthened Mary Wade’s capacity to care for some of the state’s most vulnerable residents.

This episode of CHEFA Chats, titled “Going Beyond the Rating: Mary Wade’s Bold Step Forward,” explores the story behind this remarkable project — one that demonstrates the power of innovation, trust, and community-focused investment.

Learn how one courageous decision helped redefine what’s possible when finance serves mission.

2025 CHEFA Impact Report: Financing Connecticut’s Future

For more than sixty years, the Connecticut Health and Educational Facilities Authority (CHEFA) has been at the center of building stronger communities across our state. From hospitals and universities to childcare centers, cultural institutions, and nonprofits, CHEFA provides the financing, grants, and expertise that organizations need to grow, innovate, and serve Connecticut residents.

In Fiscal Year 2025, CHEFA’s work reached new heights. The Authority issued $1.26 billion in bonds through 12 closings, supporting hospitals, universities, independent schools, and community organizations. More than 70% of these financings were new money issues, fueling expansion projects that create jobs and expand access to essential services.

Beyond bond financing, CHEFA plays a critical role in strengthening nonprofits through direct grantmaking. In FY 2025, CHEFA awarded $2.07 million in grants across Connecticut. These investments funded pediatric health vans that bring care directly to children, advanced cancer detection technology, early childhood education facilities, refugee women’s training programs, and college access initiatives for students from under-resourced communities. Together, these projects demonstrate CHEFA’s ability to translate dollars into life-changing impact.

CHEFA also expanded its Revolving Loan Fund, closing $2.79 million in loans to nonprofits seeking affordable capital for infrastructure and service improvements. Loan sizes ranged from $194,200 to $500,000, with an additional $1.5 million allocated for FY 2026. By broadening access to low-cost financing, CHEFA helps nonprofits invest in facilities and technology that directly improve community outcomes.

Strong financial stewardship continues to underpin all of CHEFA’s efforts. The Authority reported an increase of $2.48 million in net position in FY 2025, revenues of $8.2 million, and clean audits from both independent and state auditors. This stability allows CHEFA to innovate while ensuring transparency and accountability.

Looking ahead, CHEFA will continue to focus on innovation, collaboration, communication, and accountability as it expands opportunities for nonprofit organizations statewide.

CHEFA’s mission is clear: to strengthen Connecticut by supporting the institutions that educate our students, care for our families, and enrich our communities. Whether through bond financing, grants, or loans, CHEFA is committed to investing in Connecticut’s future.

Fiscal Year 2024 Hospital Sector Report Summary

At the Board of Directors Meeting held on June 18th, Staff presented a review of CHEFA’s Hospital Sector portfolio, which consists of 34 bond series totaling approximately $3.11 billion for 12 issuing entities. The report focused on FY 2024 operating results, key liquidity metrics and utilization data. The report also included an update on mergers and acquisitions, as well as Moody’s credit outlook for the sector on a national basis.

CT Hospital Mergers and Acquisitions: In May 2025, Nuvance Health officially became affiliated with Northwell Health (NY’s largest healthcare provider with 21 hospitals).

Utilization: FY 2024 utilization trends within CHEFA’s portfolio yielded mostly favorable results as total discharges, patient days, ambulatory surgeries and emergency room visits are all at their highest levels over the past five years but continue to lag pre-pandemic levels within some areas.

Operating Performance: FY 2024 operating results were more favorable compared to FY 2023 with an improved operating margin median (from -1.4% to 0.3%) and operating cash flow margin median (from 3.8% to 4.2%) as median revenue growth (at 6.1%) outpaced expense growth (at 5.5%). However operating results significantly lag those achieved in FY 2021 with four of the eleven Institutions experiencing a negative operating margin in FY 2024, (averaging -5.3%), compared to only one Institution for FY 2021 at -2.3%. The FY 2024 debt service coverage ratio median of 3.1 times remained consistent from the prior year but declined from 4.2 times five years ago.

Liquidity: The FY 2024 days cash on hand median of 153.4 days improved slightly following two years of decline but lags its high of 193.5 days in FY 2021. The range varied among the hospitals (from 14 days to 306 days) and only two institutions had more than a six-month cushion. The cash-to-debt median increased from 125.1% in FY 2023 to 153.4% in FY 2024 following a three-year decline and is at its second highest level over the past five years.

Capital Investment: Total aggregate capital spending increased 15.3% from FY 2023 to FY 2024 and is at its highest level over the past five years. A substantial disproportion in capital spending exists among the hospitals based on the size and financial strength of the entities with 3 of the health systems accounting for roughly 68% of the total spending in FY 2024. Average age of plant increased marginally from the prior year and remains high at 14.1 years compared to Moody’s overall median of 12.8 years.

Credit Outlook: Four of the eight remaining stand-alone hospitals and all four in-state and multi-state health systems in the portfolio maintain an underlying credit rating with one or more of the rating agencies. Moody’s outlook for the not-for-profit and public healthcare sector for 2025 (issued on Nov 13, 2024) reflects sector stability as profitability rises modestly on revenue growth. However, rising costs and disruptions related to Medicare reimbursement lagging inflation and regulatory scrutiny of healthcare costs and mergers will slow progress.

To learn more about CHEFA’s Hospital Sector report for FY 2024 and the performance of the 24 hospitals that make up our portfolio, please contact Krista Johnson, Senior Credit and Compliance Specialist at kjohnson@chefa.com.

Fiscal Year 2024 Senior Living Sector Report Summary

At the Board of Directors Meeting held on June 18th, Krista Johnson, Senior Credit and Compliance Specialist, presented a review of CHEFA’s Senior Living Sector portfolio, which consists of 17 bond series totaling approximately $452.6 million. The portfolio review focused on FY 2024 key profitability and liquidity metrics as well as utilization data for eleven senior living facilities, of which six facilities in the portfolio operate with an entrance fee component model.

Credit Outlook: Seven of the eleven Institutions in the portfolio have an underlying credit rating with Fitch’s Rating Agency and were evaluated collectively in comparison to Fitch’s Investment Grade (“IG”) medians. Fitch’s overall outlook of the not-for-profit life plan community sector (issued on Dec 2, 2024) projects a stable environment with the outlook revision from ‘deteriorating’ to ‘neutral’. Over the past few years, many Life Plan Communities (“LPCs”) made adjustments to operating capacity of their skilled nursing facilities to remain profitable during a high interest rate and inflationary environment. As rates continue to decline, Fitch expects the acceleration of capital financing to occur as the Baby Boomer generation quickly approaches age and income eligibility.

Occupancy: FY 2024 occupancy was at its highest level over the past five years across each type of service – skilled nursing, assisted living and independent living units. FY 2024 occupancy levels across each type of service (skilled nursing 89.2%, assisted living 88.9% and skilled nursing 92.6%) were at their highest levels over the past five years.

Operating Performance: FY 2024 operating results improved from the prior year but overall continue to lag pre-pandemic performance. The operating ratio median improved from FY 2023 to FY 2024 following three consecutive years of weakening performance but only three of the Institutions improved from five years ago. The net operating margin ratio median of 5.7% (which solely evaluates resident-based operations) also improved from the prior year, but significantly lags its high of 9.4% in FY 2021.

Liquidity: The days cash on hand median of 230.6 days in FY 2024 decreased 45.2% from five years ago and significantly lags Fitch’s IG median of 489.7 days. Liquidity was much more favorable amongst the facilities with entrance fee agreements at 385.8 days compared to those with rental fee agreements at 221.4 days. The cash-to-debt median improved from 72.6% in FY 2023 to 79.0% in FY 2024 and is at its second highest level over the past five years. The FY 2024 cushion ratio median of 12.0 times also improved from the prior year (from 11.5 times), providing more funds available for debt service but lags its high of 16.2 times in FY 2021.

Capital Structure/Cash Flow: The FY 2024 debt service coverage ratio median of 2.4 times remains relatively flat but is at its second highest level in the past five years. The debt to capitalization median at 56.5% in FY 2024 improved from its five-year high five years ago of 66.5%, is at its lowest level over the past five years and now compares more favorably to Fitch’s IG median of 53.7%. Total aggregate capital spending for FY 2024 of $150.9 million increased 41% from FY 2020 and is at its second highest level in the past five years. The median capital spending ratio of 0.8 times however significantly lags its high of 1.8 times in FY 2022.

To learn more about CHEFA’s Senior Living Sector report for FY 2024 and the performance of the eleven facilities that make up our senior living portfolio, please contact Krista Johnson, Senior Credit and Compliance Specialist at kjohnson@chefa.com.

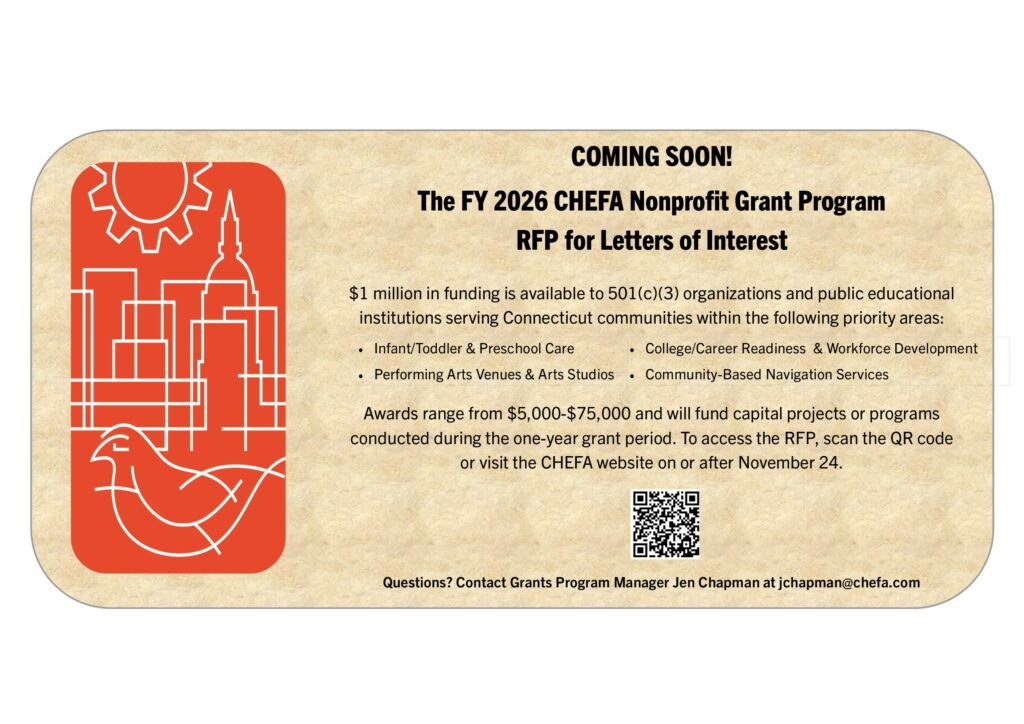

Fiscal Year 2026 Nonprofit Grant Cycle Announcement